Asset Turnover Ratio Increase Means

The asset turnover ratio tends. This ratio divides net sales by net fixed assets calculated over an annual period.

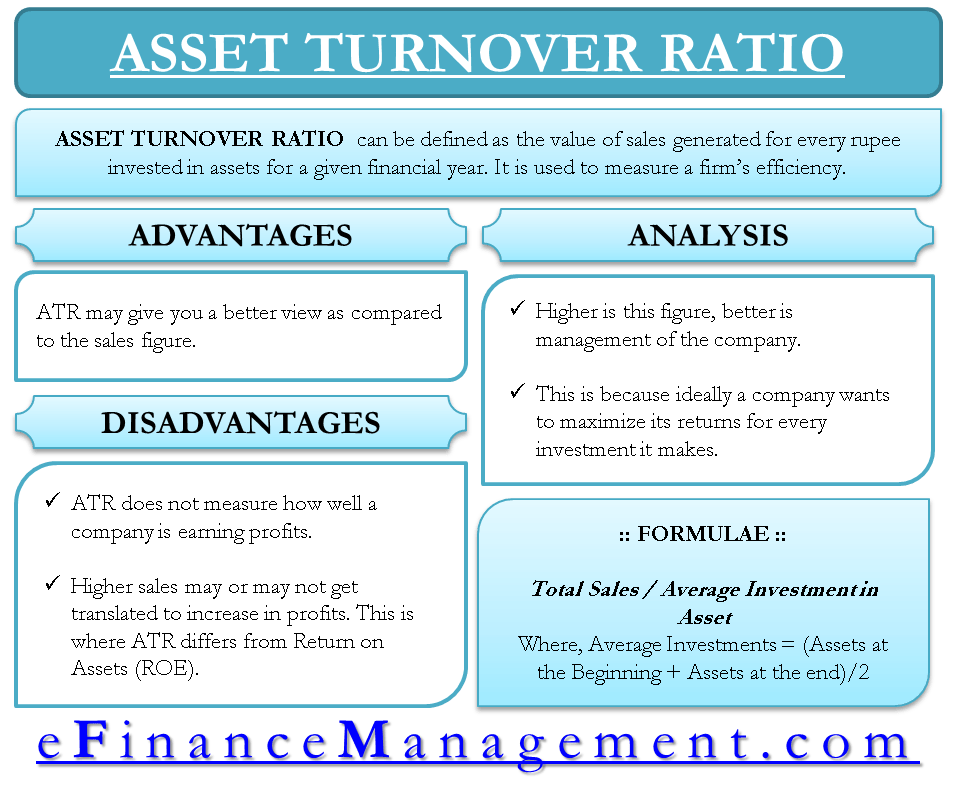

Turnover Ratios Definition All Turnover Ratios Uses Importance Efm

The higher the sales compared to the asset the high the ratios.

. The ratio should only be compared for companies operating in the same industry as the ratio varies greatly depending on the industry. The higher the asset turnover ratio the better the company is performing since higher ratios imply that the company is generating more revenue per dollar of assets. A low asset turnover ratio indicates the opposite -- that a company is not using its resources productively and may be experiencing internal struggles.

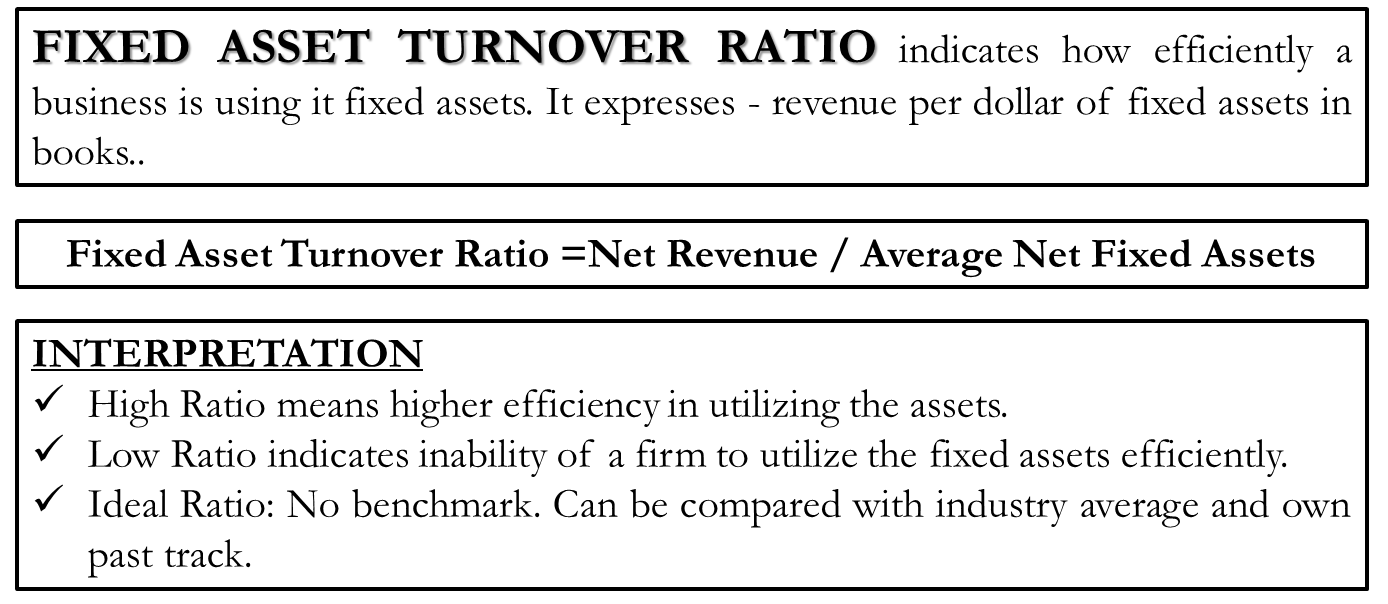

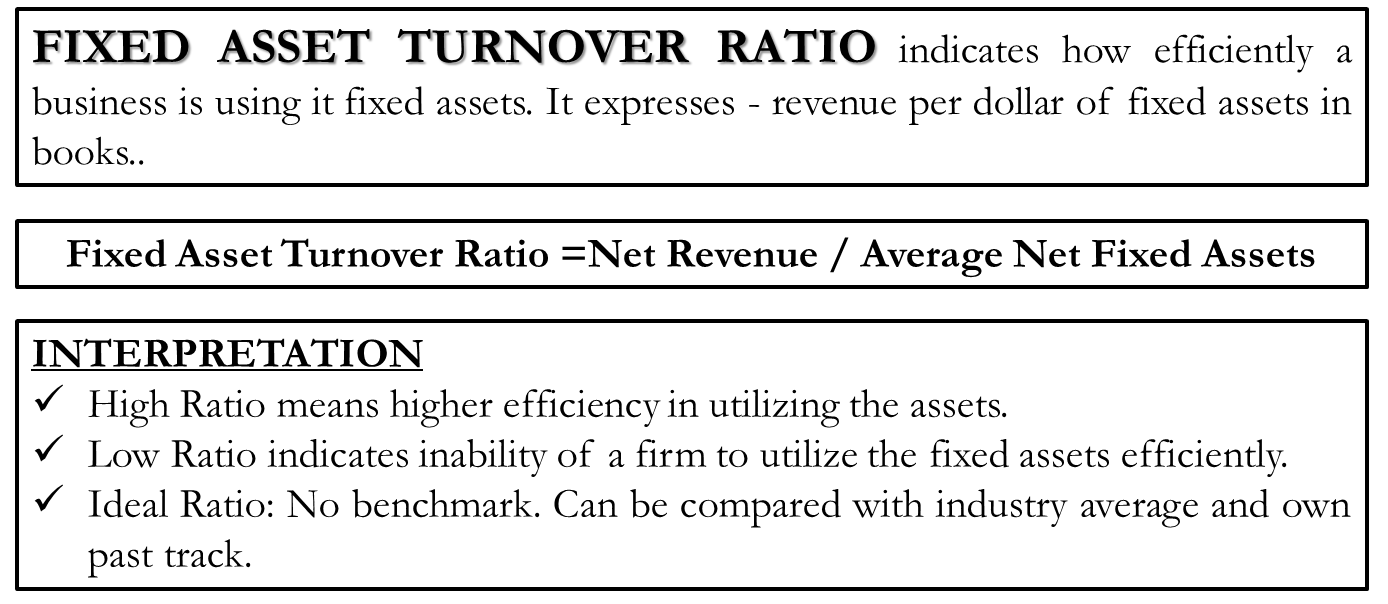

A higher fixed asset turnover ratio indicates that a company has effectively used investments in fixed assets to generate sales. On the contrary a lower turnover ratio indicates that the company is not making the best use of its resources and is more likely to have management or production issues. Fixed Asset Turnover FAT is an efficiency ratio that indicates how well or efficiently a business uses fixed assets to generate sales.

A high ratio is always favorable as it indicates reduced storage and other holding costs. As mentioned before a high asset turnover ratio means a company is performing efficiently as the ratio means they are generating more revenue per dollar of assets. The asset turnover ratio is used by investors to compare companies in the same sector or group.

Ideally a company with a high total asset turnover ratio can operate with fewer assets than a less efficient competitor and so. Inventory turnover ratio is an efficiency ratio that measures how efficiently inventory is managed. Analyze the changes in the asset turnover ratios components from year to year to determine the cause of an increase in the ratio.

Hence to get a higher ratio for your company it is advisable to focus your assets on increasing sales. The ratio measures the ability of an organization to efficiently produce sales and is typically used by third parties to evaluate the operations of a business. If rising sales led to an increase in the ratio the company is likely in good shape.

The net fixed assets include the amount of property plant and equipment less the accumulated depreciation. However when a company overstocks inventory throughout the financial year or there are inefficiencies the inventory turnover ratio will be lower. In this example sales grew from 15.

A higher asset turnover ratio indicates that the company is generating more revenue by using its assets efficiently. This improves the companys asset turnover ratio in the short term as revenue the numerator increases as the companys assets the denominator decrease. The increasing trend of this ratio is a good sign because this means that the company is working on the consistent improvement of its policies in inventory accounts receivable cash and other current assets management.

The lower inventory levels at the beginning and closing of a financial period signify a higher turnover ratio. For a business to be sustained having the right assets in play is a boon. However higher current asset turnover comparing to competitors would indicate a high intensity of the current assets usage.

Lower ratios indicate that the organisation isnt making the best use of its resources and more than likely has management or production issues. A declining trend in fixed asset turnover may mean that the company is over. Higher turnover ratios indicate that the company is making better use of its assets.

If sales and assets declined but the overall ratio still increased the company might be in trouble despite the higher ratio. An increasing trend in fixed assets turnover ratio is desirable because it means that the company has less money tied up in fixed assets for each unit of sales. Generally speaking the higher the asset turnover ratio the better as this suggests that the company is producing more sales per dollar of asset owned ie faster conversion into turnover or revenue and is an indication of being better at putting its assets to use.

Key Takeaways The fixed asset turnover ratio reveals how efficient a. However the company then has fewer. Increasing the turnover ratio of a company is dependent on sales.

Inventory levels directly impact the increase or decrease in inventory turnover ratio. The total asset turnover ratio compares the sales of a company to its asset base.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Asset Turnover Ratio Formula Meaning Example And Interpretation

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Fixed Asset Turnover Definition Formula Interpretation Analysis

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

0 Response to "Asset Turnover Ratio Increase Means"

Post a Comment